•Annual grant of Bloomin’ Brands restricted stock units (“RSUs”) having a fair market value, based on the closing price of the underlying common stock, of $100,000$150,000 (or $215,000 for the non-executive Chairman) on the date of our annual meeting of stockholders, vesting asstockholders; the 2021 annual grant provided for a schedule to vest one-third of the shares subject to the grant immediately prior to our annual meeting of stockholders each year thereafterthereafter; commencing in 2022, all newly awarded annual board grants vest in full on the date of the first annual meeting of stockholders following the grant date as explained above.

If a

non-employee director is elected at any time other than at our annual meeting of stockholders, such director will receive an initial grant of restricted stock units having a fair market value, based on the closing price of the underlying common stock on the grant date, of

$100,000$150,000 on the date of the first Board of Directors meeting that such director attends, prorated for the number of months

that such director will serve on the Board from

and including the month of the director’s

election to thefirst Board

of Directors untilmeeting as a director through the month of our next annual meeting of stockholders,

vesting as toone-third of the shares subjectrounded to the

grant immediately prior to ournearest $100 and vesting in full at the first annual meeting of stockholders

each year thereafter.following the grant date.

The Board of Directors adopted a Stock Ownership Guidelines Policy for directors, executive officers and members of our executive leadership team, which consists of the Company’s executive vice presidents, senior vice presidents, and concept presidents, and selected Group Vice Presidents (the “Executive Leadership Team”). With respect to directors, Ms. SmithMr. Deno and allnon-employee directors are required to accumulate shares of our common stock through direct purchases or retention of equity incentives (the “Stock Ownership Requirement”), equal to fivesix times base salary for Ms. Smith,Mr. Deno, and five times

the annual retainer for all

non-employee directors. The Stock Ownership Requirement must be met

noby the later

thanof December 17, 2019 or the fifth anniversary of the director’s

or executive officer’s initial election or

appointment.appointment, as applicable. Mr. Deno and all non-employee Directors have met their ownership requirement or are on track to meet their requirement before their respective deadlines.

The following table summarizes the amounts earned and paid to

non-employee directors during fiscal year

2017: | | | | | | | | | | | | | | | | | | | | |

| NAME | | FEES EARNED OR

PAID IN CASH (1)

($) | | STOCK

AWARDS (2)

($) | | ALL OTHER

COMPENSATION (3)

($) | | TOTAL

($) |

Wendy A. Beck(4) | | | | — | | | | | — | | | | | — | | | | | — | |

James R. Craigie | | | | 135,000 | | | | | 100,003 | | | | | 3,824 | | | | | 238,827 | |

David R. Fitzjohn | | | | 97,500 | | | | | 100,003 | | | | | — | | | | | 197,503 | |

Mindy Grossman | | | | 105,000 | | | | | 100,003 | | | | | 5,975 | | | | | 210,978 | |

Tara Walpert Levy | | | | 100,000 | | | | | 100,003 | | | | | 8,063 | | | | | 208,066 | |

John J. Mahoney | | | | 115,000 | | | | | 100,003 | | | | | 26,850 | | | | | 241,853 | |

R. Michael Mohan(5) | | | | 19,076 | | | | | 50,010 | | | | | — | | | | | 69,086 | |

Chris T. Sullivan(6) | | | | 90,000 | | | | | 100,003 | | | | | — | | | | | 190,003 | |

(1) | Cash retainers are paid in quarterly installments. |

(2) | Represents restricted stock units (“RSUs”), which vest 33% per year over three years. The amounts represent the aggregate grant date fair values computed in accordance with Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 718. The grant date value based on the closing price of the underlying common stock is $100,000. As of December 31, 2017, ournon-employee directors held the following aggregate number of shares of restricted stock units: Mr. Craigie, 10,767 shares; Mr. Fitzjohn, 10,767 shares; Ms. Grossman, 10,767 shares; Ms. Levy, 10,767 shares; Mr. Mahoney, 10,767 shares; Mr. Mohan, 2,928 shares; and Mr. Sullivan, none (shares were forfeited upon his resignation). |

(3) | The amounts shown in “All Other Compensation” are for reimbursements of tax, interest and fees payable by each director as a result of an administrative error by the Company in reporting previous years’ income. |

(4) | Ms. Beck joined the Board of Directors on February 28, 2018. |

(5) | R. Michael Mohan joined our Board of Directors on October 20, 2017. Since he joined the Board during the fourth quarter, the amounts paid or awarded to him werepro-rated for the period that he served as a director. |

(6) | Mr. Sullivan resigned from the Board of Directors on December 6, 2017. |

10 Bloomin’ Brands, Inc.— 2018 Proxy Statement

2022: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | FEES EARNED OR PAID IN CASH | | STOCK AWARDS (1) | | | | | | | | OTHER COMPENSATION | | TOTAL |

| NAME | | ($) | | ($) | | | | | | | | ($) | | ($) |

| James R. Craigie | | 158,750 | | | 215,006 | | | | | | | | | — | | | 373,756 | |

| David R. Fitzjohn | | 105,000 | | | 150,012 | | | | | | | | | — | | | 255,012 | |

| John P. Gainor, Jr. | | 106,250 | | | 150,012 | | | | | | | | | — | | | 256,262 | |

| Lawrence V. Jackson | | 107,500 | | | 150,012 | | | | | | | | | — | | | 257,512 | |

| Julie Kunkel | | 37,669 | | | 87,520 | | | | | | | | | — | | | 125,189 | |

| Tara Walpert Levy | | 108,750 | | | 150,012 | | | | | | | | | — | | | 258,762 | |

| John J. Mahoney | | 120,000 | | | 150,012 | | | | | | | | | — | | | 270,012 | |

| Melanie Marein-Efron | | 37,669 | | | 87,520 | | | | | | | | | — | | | 125,189 | |

| R. Michael Mohan | | 111,250 | | | 150,012 | | | | | | | | | — | | | 261,262 | |

| Elizabeth A. Smith | | 90,000 | | | 150,012 | | | | | | | | | — | | | 240,012 | |

__________________

(1)Represents RSUs, which vest in full on the date of the first annual meeting of stockholders following the grant date. The amounts represent the full aggregate grant date fair values computed in accordance with Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 718. The grant date fair market value based on the closing price of the underlying common stock is $150,000 for all directors other than Mr. Craigie and $215,000 for Mr. Craigie. As of December 25, 2022, our current non-employee directors held the following aggregate number of unvested RSUs: Mr. Craigie, 20,147 shares; Mr. Fitzjohn, 13,975 shares; Mr. Gainor, 13,761 shares; Mr. Jackson, 13,761 shares; Ms. Kunkel, 4,142 shares; Ms. Levy, 13,975 shares; Mr. Mahoney, 13,975 shares; Ms. Marein-Efron, 4,142 shares; Mr. Mohan, 13,975 shares; and Ms. Smith, 13,975 shares.

PROPOSAL NO. 2

RATIFICATION OF INDEPENDENT REGISTERED CERTIFIED PUBLIC ACCOUNTING FIRM

We are asking our stockholders to ratify the Audit Committee’s appointment of PricewaterhouseCoopers LLP as our Independent Auditor for the fiscal year ending December

30, 2018.31, 2023. The Company believes that the choice of PricewaterhouseCoopers LLP as the Independent Auditor is in the best interests of the Company and its stockholders. In the event the stockholders do not ratify the appointment, the Audit Committee will reconsider this appointment. Even if the appointment is ratified, the Audit Committee, in its discretion, may direct the appointment of a different Independent Auditor at any time during the year if the Audit Committee determines that such a change would be in

ourthe best interests of the Company and

our stockholders’ best interests.its stockholders.

PricewaterhouseCoopers LLP has audited the Bloomin’ Brands consolidated financial statements annually since we were formed and the financial statements of our predecessor since 1998. Representatives of PricewaterhouseCoopers LLP are expected to be present at the annual meeting and will have the opportunity to make a statement if they so desire. It is also expected that those representatives will be available to respond to appropriate questions.

The Audit Committee is directly responsible for the appointment, compensation and oversight of the Independent Auditor and annually reviews the firm’s qualifications and work quality. In the course of these reviews, the Audit Committee considers, among other things:

•the firm’s historical and recent plans and performance on our audit

•the firm’s capability and expertise in handling the breadth and complexity of our operations

•external data on audit quality and performance, including Public Company Accounting Oversight Board reports on the firm and its peer firms

•the firm’s independence and objectivity

•the appropriateness of the firm’s fees for audit andnon-audit services, including any effect these fees may have on independence

•the quality and candor of the firm’s communications with the committee and management

•the firm’s tenure as our Independent Auditor, including the benefits of having a long-tenured auditor and controls and processes that help safeguard the firm’s independence

Principal Accountant Fees and Services

The following is a summary of the fees billed to us by PricewaterhouseCoopers LLP for professional services rendered for the fiscal years ended December

31, 201725, 2022 and December

25, 2016: | | | | | | | | |

| FEE CATEGORY | | 2017 | | | 2016 | |

Audit Fees | | $ | 2,554,000 | | | $ | 2,874,000 | |

Audit-Related Fees | | | 153,000 | | | | 5,000 | |

Tax Fees | | | 35,000 | | | | 55,000 | |

All Other Fees | | | 8,000 | | | | 6,000 | |

Total Fees | | $ | 2,750,000 | | | $ | 2,940,000 | |

26, 2021 (dollars in thousands):

| | | | | | | | | | | | | | |

| FEE CATEGORY | | 2022 | | 2021 |

| Audit Fees | | $ | 1,666 | | | $ | 2,149 | |

| Audit-Related Fees | | 12 | | | 143 | |

| Tax Fees | | 158 | | | 110 | |

| All Other Fees | | 5 | | | 3 | |

| Total Fees | | $ | 1,841 | | | $ | 2,405 | |

Audit Fees. The aggregate audit fees (inclusive ofout-of-pocket expenses) billed by PricewaterhouseCoopers LLP were for professional services rendered for the audits of our consolidated and subsidiary financial statements and services that are normally provided by the independent registered certified public accountants in connection with statutory and regulatory filings or engagementsengagements. These fees represent work for the fiscal years ended December 31, 201725, 2022 and December 25, 2016,26, 2021, including audited consolidated financial statements presented in our Annual Reports on Form10-K and the review of the financial statements presented in our Quarterly Reports on Form10-Q.Bloomin’ Brands, Inc. — 2018 Proxy Statement 11

In addition, services rendered included additional audit services associated with the repurchase of our convertible notes during the fiscal year ended December 25, 2022 and our debt refinancing and capital restructuring during the fiscal year ended December 26, 2021.

Audit-Related Fees.The aggregate audit-related fees (inclusive ofout-of-pocket expenses) billed by PricewaterhouseCoopers LLP were for assurance and related services that are reasonably related to the performance of the audit or review of our consolidated financial statements and are not reported under “Audit Fees.” These services comprised of reviewsconsents and review of certaindocuments in connection with our franchise disclosure documents during the fiscal years ended December 31, 201725, 2022 and December 25, 2016,26, 2021, and delivery of comfort letters, consents and review of company-preparedness for new accounting standards and tax reformdocuments in connection with our issuance of senior notes during the fiscal year ended December 31, 2017.26, 2021.

Tax Fees.The aggregate tax fees (inclusive ofout-of-pocket expenses) billed by PricewaterhouseCoopers LLP were for professional services for tax compliance, tax advice and tax planning. These services include assistance regarding U.S. tax consulting and foreign jurisdictionBrazil tax compliance and planning forduring the fiscal years ended December 31, 201725, 2022 and December 25, 2016.26, 2021 and Brazil tax consulting during the fiscal year ended December 26, 2021.

All Other Fees.The aggregate of all other fees billed by PricewaterhouseCoopers LLP were for products and services other than the services reported above. These services included annual subscription licenses for accounting research and disclosure review tools, which we license from PricewaterhouseCoopers LLP, and continuing professional education seminars hosted by PricewaterhouseCoopers LLP forduring the fiscal years ended December 31, 201725, 2022 and December 25, 2016.26, 2021.

Policy on Audit Committee

Pre-Approval of Audit and Permissible

Non-Audit Services of Independent Auditor

The Audit Committee has established a policy requiring its

pre-approval of all audit and permissible

non-audit services (including the fees and terms thereof) provided by our Independent Auditor. The policy provides for the general

pre-approval of specific types of services within specific cost limits for each such service on an annual basis. The policy requires specific

pre-approval of all other permitted services. The Chairman of the Audit Committee has the authority to address any requests for

pre-approval of services between Audit Committee meetings, and the Chairman must report any

pre-approval decisions to the Audit Committee at its next scheduled meeting.

Recommendation of the Board of Directors

The Board of Directors recommends that the stockholders voteFOR ratification of the appointment of PricewaterhouseCoopers LLP to serve as our independent registered certified public accounting firm for the fiscal year ending December 30, 2018.12 Bloomin’ Brands, Inc.— 2018 Proxy Statement

31, 2023.

PROPOSAL NO. 3

ADVISORY VOTE ON EXECUTIVE COMPENSATION

We provide our stockholders with the opportunity to vote to approve, on a

non-binding, advisory basis, the compensation of our named executive officers as disclosed in this proxy statement in accordance with section 14A of the Securities Exchange Act (“Exchange Act”). This vote is referred to as a

“say-on-pay” “say-on-pay” vote.

The Compensation Discussion and Analysis beginning on page 1637 and the compensation tables and narrative discussion beginning on page 2951 of this proxy statement describe our executive compensation program and the compensation of our named executive officers for 2017.2022. The Board of Directors is asking stockholders to cast an advisory vote indicating their approval of that compensation by votingFOR the following resolution:

“RESOLVED, that the stockholders of Bloomin’ Brands APPROVE, on an advisory basis, the compensation paid to its named executive officers, as disclosed pursuant to the compensation disclosure rules of the Securities and Exchange Commission, including the Compensation Discussion and Analysis, compensation tables and narrative discussion.”

As described in detail in the Compensation Discussion and Analysis, we have a total compensation approach focused on performance-based incentive compensation that seeks to drive a pay for performance culture and:

•attract and retain qualified executives in today’s highly competitive market

•motivate and reward executives whose knowledge, skills and performance are critical to the success of the business

•provide a competitive compensation package that aligns management and stockholder interests by tying a significant portion of an executive’s cash compensation and long-term compensation to the achievement of annual performance goals

•ensure internal equity among the executive officers by recognizing the contributions each executive makes to the success of Bloomin’ Brands

The

As further described in the Compensation Discussion and Analysis, the Compensation Committee regularly reviews our executive compensation program to

establishmaintain a strong connection between compensation and the aspects of our performance that our executive officers can impact and that are likely to have an effect on stockholder value.

We believe that in 2017, our continued enhancements to the guest experience, optimization of our domesticgo-to market strategy through targeted refranchising and restaurant relocations, investment in emerging Off Premises opportunity, and refinancing of our credit facility demonstrate the effective relationship between corporate goals and our compensation program.

The vote on this

“say-on-pay” “say-on-pay” proposal is advisory, which means that the vote will not be binding on Bloomin’ Brands, the Board of Directors or the Compensation Committee. The Compensation Committee will review and consider the results of the vote on this proposal in connection with its regular evaluations of our executive compensation program. As the Board of Directors has currently determined to hold this vote each year, the next

“say-on-pay” “say-on-pay” vote will be held at the

2019 annual meeting2024 Annual Meeting of

stockholders.Stockholders.

Recommendation of the Board of Directors

The Board of Directors recommends that the stockholders voteFOR the advisory approval of the compensation of our named executive officers.

PROPOSAL NO. 4

APPROVAL TO AMEND THE COMPANY’S CHARTER TO PROVIDE STOCKHOLDERS HOLDING A COMBINED 25% OR MORE OF OUR COMMON STOCK WITH THE RIGHT TO REQUEST A SPECIAL MEETING OF STOCKHOLDERS

General

We are seeking approval to amend our Fourth Amended and Restated Certificate of Incorporation (also referred to as the “Charter”) to provide stockholders owning a combined 25% or more of the Company’s outstanding common stock with the right to request a special meeting of stockholders, subject to certain ownership and procedural requirements outlined below.

Background

Our stockholders do not presently have the right to request that the Company call a special meeting of stockholders. As part of the Board’s and the Nominating and Corporate Governance Committee’s ongoing review of the Company’s corporate governance standards, the Board and the Nominating and Corporate Governance Committee have continued to consider whether it was appropriate and timely to provide stockholders with the right to request a special meeting of stockholders.

In evaluating the advisability of providing stockholders with the right to request a special meeting, the Board and the Nominating and Corporate Governance Committee considered certain positions for and against such a right, stockholder feedback (including the vote of approximately 74% of our outstanding shares in favor of such a right as proposed by the Board in our 2022 proxy statement and the vote of only approximately 40% of our outstanding shares in favor of the right as proposed by one of our stockholders in our 2022 proxy statement), trends and best practices in corporate governance, market practice, and the current stockholder proposal regarding special meeting rights (Proposal No. 6) on page 26. After careful consideration, the Board and the Nominating and Corporate Governance Committee continues to believe that the adoption of a right for stockholders to request a special meeting pursuant to amendments to the Charter as set forth in this Proposal establishes the appropriate balance between enhancing stockholder rights and adequately protecting stockholder interests.

If stockholders approve this Proposal, the Board also intends to amend our Third Amended and Restated Bylaws (the “Bylaws”) to provide for certain ownership and procedural requirements relating to the right to call a special meeting as summarized below. These anticipated amendments to the Bylaws (the “Bylaws Amendments”) do not require separate stockholder action.

Overview and Effects of the Amendments

While the Board recognizes that providing stockholders with the right to request special meetings is viewed by some stockholders as an important corporate governance practice, the Board considers special meetings to be extraordinary events that a significant number of stockholders should support. Special meetings should not be a mechanism that a small group of stockholders can misuse to advance private agendas and interests that our broader stockholder base may not share. To ensure that the stockholders’ right to request a special meeting provides our

stockholders with an equitable manner to raise matters for consideration by stockholders while also addressing concerns that the ability for stockholders to request a special meeting could be subject to abuse absent adequate procedural safeguards, the proposed Charter amendments will require compliance with the Company’s Bylaws to request a special meeting, which, after adoption of the Bylaws Amendments by the Board, will include the following safeguards:

•Ownership provisions. Organizing and preparing for a special meeting can result in substantial expenses to the Company and divert significant time and attention of our Board and management away from their primary focus of operating our business and creating long-term stockholder value. Although the current stockholder proposal (Proposal No. 6) seeks a 10% common stock ownership threshold for requesting special meetings, the Board believes that requiring a higher common stock ownership threshold for stockholders to request a special meeting would strike a more appropriate balance between enhancing stockholder rights and mitigating the risk that a small minority of stockholders with narrow self-interests that may not be shared by the majority of the Company’s stockholders could waste corporate resources and disrupt our business. For example, the Company’s current stockholder composition would allow one or two stockholders to satisfy the threshold of owning in excess of 10% of the Company’s common stock, and the Board believes it would be prudent and in the best interests of the Company and its stockholders to establish a threshold that would require more than a nominal number of stockholders to request a special meeting. This view was supported by a significant number of our stockholders that we engaged with during our prior engagement efforts and, while our stockholders expressed a variety of preferences and ranges, either in the engagement or in their published policies, we found broad support for a 25% ownership threshold. In addition, a 25% ownership threshold is consistent with market practice, and, according to data from Deal Point Data, a corporate governance database, approximately 48% of S&P 500 companies that provide a special meeting request right have set the ownership threshold at or greater than 25%. Accordingly, the proposed Charter amendment and the Bylaws Amendments to be adopted by the Board will require that, to request a special meeting, stockholders must hold, at the time the special meeting request is delivered, net long beneficial ownership of at least 25% of our outstanding shares of common stock for at least one year.

The definition of net long beneficial ownership will include shares of our common stock that have the sole power to vote or direct the voting, the sole economic interest (including the sole right to profits and the sole risk of loss), and the sole power to dispose of or direct the disposition, and are subject to certain exclusions as described in the Bylaws Amendments. The Board believes that net long beneficial ownership with a one-year holding period is appropriate to ensure that only stockholders with long-term interests, full voting rights and economic interest in the Company would be entitled to request a special meeting.

•Information provisions. To ensure transparency, stockholders that request a special meeting must provide the Company with the purpose of the requested special meeting, provide the same information and representations that would be required to propose that action or nominate a candidate at an annual meeting and contain the text of any resolutions to be considered by stockholders at the special meeting.

•Continued ownership. To ensure that the stockholders that request a special meeting maintain sufficient interest in the business of the Company and to prevent waste of corporate resources and disruptions for narrow self-interests by stockholders that no longer maintain an interest in the Company, the requesting stockholders must maintain net long beneficial ownership of at least 25% of our outstanding shares of common stock through any special meeting called as a result of a special meeting request.

•Additional provisions. To ensure that the special meeting request is in compliance with applicable laws and is not duplicative, the right of stockholders to request a special meeting would not be available in a limited number of circumstances, including:

i.If the special meeting request does not comply with the requirements of the Company’s governing documents;

ii.If the special meeting request relates to an item of business that is not a proper subject for action by the stockholders of the Company under applicable law;

iii.If a special or annual meeting of stockholders has been called or is called to be held within 90 days after the Company receives a valid special meeting request and the Board determines that the business at the annual or special meeting of stockholders includes the business in the stockholders’ special meeting request;

iv.If a special meeting request is received by the Company during the period commencing 90 days prior to the first anniversary of the date of the most recent annual meeting and ending on the date of the final adjournment of the next annual meeting;

v.If an identical or substantially similar item was presented at a meeting of stockholders held within 120 days before the Company received the special meeting request (the nomination, election or removal of directors is a similar item with respect to all items involving the nomination, election or removal of directors, changing the size of the Board, or filling vacancies);

vi.If two or more stockholder-requested special meetings have been held in the twelve months prior to the date that the special meeting request is received by the Company; or

vii.If the special meeting request was made in a manner that involved a violation of Regulation 14A under the Exchange Act or other applicable law.

The business conducted at any special meeting requested by stockholders will be limited to the purpose stated in the request for the special meeting, but the Board may in its discretion submit additional matters for consideration.

The provisions in the Bylaws Amendments could be further amended in the future by Bylaws amendments adopted by the Board or our stockholders.

The general description in this Proposal of the amendments to the Charter is qualified in its entirety by reference to the text of the proposed Charter amendment, which is attached to this proxy statement as Appendix A and is marked to show the changes described above. In addition, the text of the Bylaws Amendments, which can be further amended from time to time, is attached as Appendix B and is also marked to show the proposed changes.

The Stockholder Proposal Regarding Special Meeting Rights

As noted above, a stockholder proponent has notified us that he intends to submit Proposal No. 6 at the annual meeting, which is an advisory and non-binding stockholder proposal asking the Board to take steps to provide stockholders with a right to call special meetings using a significantly lower ownership threshold of 10% (the “Stockholder Special Meeting Proposal”). The Stockholder Special Meeting Proposal does not amend either the Charter or the Bylaws. For the reasons outlined above, as well as below in our Board of Directors’ Statement in Opposition to Proposal No. 6, the Board believes that this Proposal No. 4 is more closely aligned with market practice, is supported by feedback received on the proposals regarding the right of stockholders to call a special meeting presented in our 2022 proxy statement, and more appropriately balances the rights of stockholders with the long-term interests of the Company and our stockholders. Notably, the Company’s proposal in 2022 received a vote in favor by approximately 74% of our outstanding shares, which was just below the then-required 75% threshold for approval. This approval standard was reduced to a simple majority vote by a vote of our stockholders to amend our Charter at our 2022 annual meeting, which amendment became effective on April 20, 2022.

Procedural Matters

This Proposal No. 4 is a binding amendment to our Charter, and, if approved, will result in stockholders having a right to request a special meeting promptly after the annual meeting.

The affirmative vote of the holders of at least a majority of the outstanding shares entitled to vote at the annual meeting is required to approve this Proposal No. 4 and amendments to the Charter.

If stockholders approve this Proposal, the Company intends to file the amended Charter with the Secretary of State of the State of Delaware, to become effective at the time of filing, and the Board will adopt the Bylaws Amendments at the same time. If such votes are not received, the amendments to the Charter and Bylaws will not be adopted and stockholders will not have the right to request a special meeting of stockholders.

Approval of this Proposal No. 4 is not conditioned on approval or disapproval of the Stockholder Special Meeting Proposal, which means that the foregoing effects of the approval or disapproval of this Proposal No. 4 are not affected by approval or disapproval of the Stockholder Special Meeting Proposal. If this Proposal No. 4 is approved and Proposal No. 6 is also approved, the Company will implement this Proposal No. 4 and not implement Proposal No. 6. In that circumstance, the Company will consider approval of this Proposal No. 4 as supporting implementation of this Proposal No. 4 even if Proposal No. 6 is also approved. If this Proposal No. 4 is not approved by the requisite vote, neither the Charter amendments nor the Bylaws Amendments will become effective, and the Company’s stockholders will not have the right to request that the Company call a special meeting of stockholders.

Neither the proposed amendments to the Charter in Proposal No. 4 nor the Stockholder Special Meeting Proposal affect the Board of Directors’ existing authority to call a special meeting.

Recommendation of the Board of Directors

The Board of Directors recommends that the stockholders vote FOR approval of the amendments to the Charter related to stockholders’ right to request a special meeting.

PROPOSAL NO. 5

APPROVAL TO AMEND THE COMPANY’S CHARTER TO PERMIT THE EXCULPATION OF OFFICERS CONSISTENT WITH CHANGES TO DELAWARE GENERAL CORPORATION LAW

General

We are seeking approval to amend our Charter to permit the exculpation of officers consistent with changes to Delaware General Corporation Law (“DGCL”), as outlined below.

Background

Section 102(b)(7) of the DGCL was amended effective August 1, 2022 to authorize exculpation of officers of Delaware corporations. Specifically, the amendments extend the opportunity for Delaware corporations to exculpate their officers, in addition to their directors, for personal liability for breach of the duty of care in certain actions. This provision would not exculpate officers from liability for breach of the duty of loyalty, acts or omissions not in good faith or that involve intentional misconduct or a knowing violation of law, or any transaction in which officers derived an improper personal benefit. Nor would this provision exculpate such officers from liability for claims brought by or in the right of the corporation, such as derivative claims.

The Board believes it is necessary to provide protection to officers to the fullest extent permitted by law in order to attract and retain top talent. This protection has long been afforded to directors. Accordingly, the Board believes that this proposal to extend exculpation to officers is fair and in the best interests of the Company and its stockholders.

Effects of the Amendments and Procedural Matters

The proposed amendments to the Charter would authorize the exculpation of officers for personal liability for breach of the duty of care in certain actions as permitted by Section 102(b)(7) of the DGCL.

This general description in this Proposal of the amendments to the Charter is qualified in its entirety by reference to the text of the proposed Charter amendment, which is attached to this proxy statement as Appendix C and is marked to show the changes described above.

The affirmative vote of the holders of at least a majority of the outstanding shares entitled to vote at the annual meeting is required to approve this Proposal No. 5 and amendments to the Charter.

If stockholders approve this Proposal, the Company intends to file the amended Charter with the Secretary of State of the State of Delaware, to become effective at the time of filing. If our stockholders do not approve this Proposal, then the changes shown in Appendix C will not be adopted.

This Proposal No. 5 is separate and independent from Proposal No. 4. If both proposals are approved, we will combine the proposed changes in Appendix A and Appendix C into one consolidated Amended and Restated Certificate of Incorporation.

Recommendation of the Board of Directors

The Board of Directors recommends that the stockholders vote FOR approval of the amendments to the Charter to permit the exculpation of officers.

PROPOSAL NO. 6

STOCKHOLDER PROPOSAL TO ADOPT A STOCKHOLDER RIGHT TO CALL A SPECIAL STOCKHOLDER MEETING

We have received notice of the intention of stockholder Kenneth Steiner to present the following proposal at the annual meeting. In accordance with federal securities regulations, the text of the stockholder proposal and supporting statement appears below exactly as received, other than minor formatting changes. The contents of the proposal or supporting statement are the sole responsibility of the proponent, and we are not responsible for the content of the proposal or any inaccuracies it may contain. The Company will promptly provide the address of the proponent and the number of shares owned by him upon request directed to the Company’s Corporate Secretary.

As explained below, the Board of Directors does not support the adoption of this proposal and asks stockholders to consider its response following the proponent’s statement below. If the proposal is properly presented at the annual meeting, the Board of Directors recommends you vote AGAINST this proposal.

* * *

Proposal 6 - Adopt a Shareholder Right to Call a Special Shareholder Meeting

Shareholders ask our board to take the steps necessary to amend the appropriate company governing documents to give the owners of a combined 10% of our outstanding common stock the power to call a special shareholder meeting regardless of length of stock ownership.

One of the main purposes of this proposal is to give shareholders the right to formally participate in calling for a special shareholder meeting regardless of their length of stock ownership to the fullest extent possible.

Some companies prohibit shareholders from participating in calling for a special shareholder if they own stock for less than one continuous year. Requiring one continuous year of stock ownership can serve as a poison pill. I know of no instance of shareholders ever having success in calling for a special shareholder meeting at a company that excludes all shares not held for a continuous full year.

It is important to vote for this Shareholder Right to Call a Special Shareholder Meeting proposal because we have no right to act by written consent. Shareholders at many companies have a right to call a special shareholder and the right to act by written consent.

A reasonable shareholder right to call for a special shareholder meeting could give directors more of an incentive to improve their performance. For instance, John Mahoney, Chair of the BLMN Audit Committee, received up to 70-times the negative votes as other directors at our 2021 annual meeting. Mr. Mahoney has a free ride until 2024 when he next stands for re-election.

Plus our excessive executive pay was rejected by 35% of shares in 2021 when a 5% rejection rate is the norm.

This is a corporate governance improvement proposal like the 2021 BLMN shareholder proposal to eliminate our undemocratic 75%-voting thresholds that won our outstanding 92%-support and was adopted. It is also like the

2020 BLMN shareholder proposal for one-year terms for directors which received our 84% support and will be fully adopted in 2024.

To make up for our lack of a right to act by written consent we need the right of 10% of shares to call for a special shareholder meeting.

Please vote yes:

Adopt a Shareholder Right to Call a Special Shareholder Meeting

Statement of the Board of Directors in Opposition to the Stockholder Proposal

The Board has carefully considered this stockholder proposal and believes that it is not in the best interests of our stockholders for the reasons outlined below. Accordingly, the Board unanimously recommends that stockholders vote AGAINST this Proposal No. 6 and instead approve the Company’s special meeting right proposal outlined in Proposal No. 4.

Our Company’s Special Meeting Right Proposal is More Consistent with Market Practice

We are recommending that our stockholders approve the amendments to the Charter described in Proposal No. 4, which would enable stockholders who hold, in the aggregate, at least 25% of our outstanding common stock to request a special meeting of stockholders. In contrast, the stockholder proposal described in this Proposal No. 6 asks the Board to take steps to allow stockholders who hold, in the aggregate, at least 10% of our common stock to call special meetings. A 25% ownership threshold is more consistent with market practice. According to data from Deal Point Data, a corporate governance database, approximately 48% of the companies included in the S&P 500 that afford stockholders the right to request a special meeting have set the ownership threshold for the exercise of such a right at 25% or greater, while only 23.8% have adopted a 10% ownership threshold.

Our Company’s Special Meeting Right Proposal More Appropriately Balances Stockholder Rights with the Protection of the Long-Term Interests of the Company and our Stockholders

In addition to not aligning with market practice, the Board believes that the stockholder proposal does not strike the appropriate balance between enhancing stockholder rights and protecting the long-term interests of the Company and our stockholders. The Board recognizes that some stockholders consider a right to request special meetings to be an important corporate governance practice; however, the Board believes it is also prudent to balance this right against the risk of abuse that could be caused by giving a small number of stockholders a disproportionate amount of influence and also cause us to unduly incur substantial costs and distraction.

Convening a special meeting can result in substantial expenses to the Company and diversion of significant time and attention of our Board and executive management away from their primary focus of operating our business and creating long-term stockholder value. We currently have stockholders that own in excess of the stockholder proposal’s 10% threshold and one or a small minority of stockholders should not be entitled to cause such significant expense and distraction to potentially advance their own special interests which may not be shared more broadly by stockholders. Accordingly, the Board believes that special meetings are extraordinary events held only if a significant number of stockholders is in agreement that a special meeting is necessary to discuss critical, time-sensitive issues that cannot wait until our next annual meeting. A failure to receive 25% support to convene a special meeting is a strong indicator that the issue is unduly narrow and not deemed critical by our stockholders generally. Providing a special meeting request right at an even lower threshold risks giving a small number of stockholders a disproportionate amount of influence over our affairs and a heightened ability to misuse the right to advance private agendas and interests.

As a result of these considerations and feedback we gathered during our prior stockholder engagement efforts, which reflected broad support for a 25% ownership threshold, the Board believes that the 25% threshold in the Company’s special meeting right proposal outlined in Proposal No. 4 strikes a more appropriate balance than the 10% threshold in this stockholder proposal between ensuring that stockholders have the right to request a special meeting to act on extraordinary and urgent matters and minimizing the risk that one or small minority of stockholders will pursue special interests that are not aligned with or in the best interests of stockholders generally and cause the Company to unduly incur substantial costs and distraction.

The Stockholder’s Proposal Would Permit Stockholders Without Full Economic Interests or Voting Rights in the Company to Expend Significant Company Resources for Special Meetings and Unduly Influence Important Corporate Actions

As noted in our Proposal No. 4, the Board believes that only stockholders with full voting, investment, and economic interests in our common stock should be entitled to request that we undertake the burden and cost of calling a special meeting as those stockholders are likely to have the most vested interest in our performance and the outcome of the likely extraordinary matters to be addressed at a special meeting. As such, our Board included a “net long” stock ownership requirement with a one-year holding period in our proposed amendments to our Charter and the Bylaws Amendments. In contrast, the stockholder proposal does not include a “net long” requirement, and as such would permit stockholders with less than full economic interests and voting rights in the Company to influence important corporate actions. For example, the stockholder proposal would permit a 10% “nominal” stockholder (that has fully hedged its exposure to our stock performance through use of derivatives, such that it has no “net” economic exposure) to request a special meeting, even though other stockholders (with unhedged positions that are genuinely exposed to our stock performance) do not wish to incur that expense or divert those resources.

Our Stockholders’ Right to be Informed and Vote on Significant Matters is Ensured and Protected by State Law and Other Regulations

As a Delaware corporation, stockholder approval is required for any significant corporate actions by the Company, such as an amendment of the certificate of incorporation, a merger sale, lease or exchange of all or substantially all of its property and assets, and dissolution. Additionally, as a NASDAQ-listed company, the Company is required to seek stockholder approval for the issuance of stock in many circumstances, including equity-based compensation and an issuance that would result in a change of control. NASDAQ listing rules further prohibit the Company from taking any corporate action or issuance that disparately reduces or prohibits the voting rights of its existing stockholders. Thus, the opportunity for stockholder votes on significant corporate matters that may arise between annual meetings of stockholders is already well-established.

Stockholders Already Rejected the Same Proposal in 2022 for a 10% Ownership Threshold to Call a Special Meeting

At the 2022 annual meeting, the Company’s stockholders defeated a stockholder proposal submitted by the same proponent, which recommended that the Board take the steps necessary to amend the Company’s governing documents to give holders in the aggregate of 10% of the Company’s common stock the right to call a special meeting.

This stockholder referendum reinforced the Board’s conclusion that 10% is not the appropriate threshold and is inconsistent with good corporate governance practices. The proponent is now asking the stockholders to reconsider a decision they made a year ago.

The Company’s proposal in 2022, on the other hand, to enable stockholders who hold, in the aggregate, at least 25% of our outstanding common stock to request a special meeting of stockholders, received approval by approximately 74% of our outstanding shares, which was just below the then-required 75% threshold for approval. This approval standard was reduced to a simple majority vote by a vote of our stockholders to amend our Charter at our 2022 annual meeting, which amendment became effective on April 20, 2022.

The Company is Committed to Strong and Effective Corporate Governance Policies and Practices that Ensure Accountability and Responsiveness to Stockholders

Our existing corporate governance policies and practices demonstrate and promote our accountability to stockholders. The Board regularly reviews our policies, taking into account market practices and trends and stockholder feedback. The Company maintains robust governance practices that promote Board accountability, including:

•a majority voting standard applies in uncontested elections of directors, with directors who fail to receive the required majority vote required to tender their resignation for consideration by the Board;

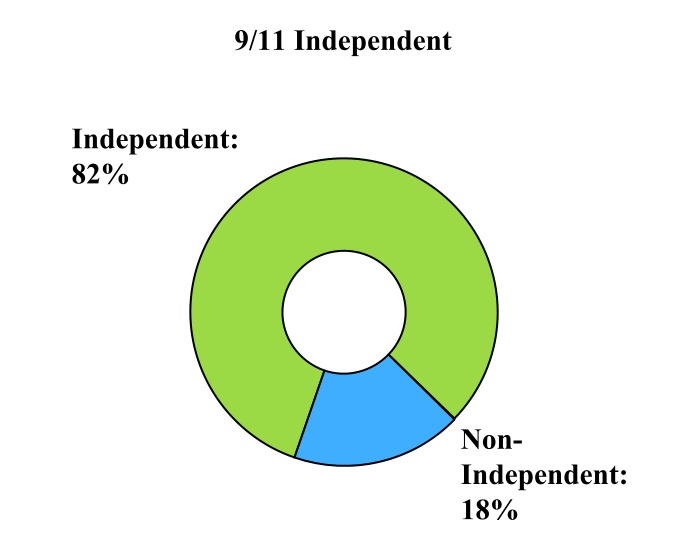

•nine of our 11 directors are “independent” under the standards adopted by the Securities and Exchange Commission and NASDAQ;

•the Board has an independent Chairman;

•the Audit, Compensation, and Nominating and Corporate Governance Committees are each comprised solely of independent directors;

•the Board established a mandatory retirement age for all directors other than the Company’s Chief Executive Officer, which requires each director who has reached the age of 72 to tender his or her resignation, to be effective immediately at the end of such director’s then-current term;

•the Board established term limits for all directors other than the Company’s Chief Executive Officer, which requires each director who has reached 12 years of service on the Board to tender his or her resignation, to be effective immediately at the end of such director’s then-current term;

•an annual say-on-pay vote; and

•an active stockholder engagement program with unaffiliated stockholders.

If approved, this stockholder proposal would not automatically provide stockholders with the right to request special meetings, as this proposal is a recommendation to the Board to take steps necessary to amend our governing documents to provide stockholders with the right to request special meetings.

The Board values opinions and proposals from our stockholders and has made efforts to implement stockholder requests that the Board believes to be in the best interests of the Company and our stockholders, such as declassifying the Board and eliminating supermajority voting requirements. However, after careful consideration of this proposal, the Board has determined that, in light of our existing governance policies and practices and the Company’s special meeting right proposal outlined in Proposal No. 4, the adoption of the special meeting right requested by this stockholder proposal is not in the best interests of the Company or our stockholders and will risk giving one or a small group of stockholders a disproportionate amount of influence over our affairs at substantial cost and distraction to the Board and management team.

Recommendation of the Board of Directors

The Board of Directors unanimously recommends a vote AGAINST this proposal related to stockholders’ rights to request a special meeting.

PROPOSAL NO. 7

STOCKHOLDER PROPOSAL REQUESTING THAT THE COMPANY ISSUE NEAR- AND LONG-TERM SCIENCE-BASED GHG REDUCTION TARGETS

We have received notice of the intention of stockholder Green Century Capital Management Inc. (“Green Century”) to present the following proposal at the annual meeting. In accordance with federal securities regulations, the text of the stockholder proposal and supporting statement appears below exactly as received, other than minor formatting changes. The contents of the proposal or supporting statement are the sole responsibility of the proponent, and we are not responsible for the content of the proposal or any inaccuracies it may contain. The Company will promptly provide the address of the proponent and the number of shares owned by it upon request directed to the Company’s Secretary.

As explained below, the Board of Directors does not support the adoption of this proposal and asks stockholders to consider its response following the proponent’s statement below. If the proposal is properly presented at the annual meeting, the Board of Directors recommends you vote AGAINST this proposal.

* * *

Whereas: As one of the world's largest casual dining companies with more than 1,450 restaurants in 17 countries, Bloomin’ Brands Inc. — 2018 Proxy sources significant volumes of commodities that have high carbon footprints, including palm oil, soy, beef, and pulp/paper, which are also leading drivers of global deforestation.

According to the Intergovernmental Panel on Climate Change, agriculture, forestry, and other land use change is responsible for 23 percent of total net anthropogenic greenhouse gas (GHG) emissions, nearly half of which are attributable to deforestation.

In its 2021 10-K, Bloomin’ acknowledges that climate change may adversely affect commodity costs and operating results. However, unlike many peers, Bloomin’ discloses neither its carbon nor forest footprints, has adopted no emissions reduction targets, and lacks a policy to address its deforestation risk.

By contrast, competitors including Chipotle, McDonald’s, and Yum! Brands have made commitments to reduce emissions throughout their full value chains, including from agricultural and land use sources. (Bloomin’ identifies growing competition from quick service and fast casual restaurants as a risk in its 2021 10-K.) As emissions disclosure, robust GHG reduction targets, no-deforestation policies, and action plans become the industry standard, Bloomin’s lack thereof increasingly lags peer companies that are positioning themselves to address these climate and deforestation risks.

Furthermore, at COP26, financial institutions with nearly US $9 trillion in AUM committed to eliminate agricultural-commodity-driven deforestation from their portfolios by 2025. As an increasing number of asset managers incorporate deforestation risk into their investment decision making, Bloomin’ must achieve a deforestation-free supply chain by 2025 or risk becoming uninvestable.

Finally, despite a 76% majority vote on a 2021 proposal asking Bloomin’ to issue a report assessing if and how the company could increase the scale, pace and rigor of its efforts to reduce its total contribution to climate change, the company has issued no such report and Bloomin’s updated website provides only a vague and cursory outline of the Company’s aspirations to reduce emissions - an inadequate response to the majority vote.

Failure to adopt policies and implement tactics that mitigate climate and deforestation risk may subject Bloomin’ to significant systemic and company-specific risks, including restricted market share, supply chain disruption, and reputational risk.

Resolved: Shareholders request that Bloomin’ Brands, within a year, issue near- and long-term science-based GHG reduction targets aligned with the Paris Agreement’s ambition of maintaining global temperature rise to 1.5 degrees Celsius and summarize plans to achieve them. The targets should cover the company’s full range of operational and supply chain emissions (including Scopes 1, 2 and 3).

Supporting Statement: In assessing targets, proponents recommend:

•Considering approaches used by advisory groups such as the Science Based Targets initiative;

•Developing a transition plan that shows how the company plans to meet its goals;

•Considering emissions reduction targets inclusive of all GHG Protocol-defined sources of Scope 3 emissions—including from agriculture, land use change, and deforestation

•Considering a no-deforestation policy for all forest-risk commodities in the company’s supply chain.

* * *

Statement 13 of the Board of Directors in Opposition to the Stockholder Proposal

The Board has carefully considered the above proposal and believes that it is not in the best interests of the Company and our stockholders. Consequently, the Board unanimously recommends a vote AGAINST this Proposal No. 7.

The Board of Directors and our management team recognize the significance of climate change and the importance of managing the environmental impact of the operations of the Company’s business. Understanding that these issues are increasingly a focus of stockholders, we believe we are addressing them in an appropriate manner, as outlined below. Since stockholder approval of Green Century’s proposal in 2021 requesting the Company issue a report on the Company’s efforts to reduce our total contribution to climate change, we have accomplished the following:

•assessed and published Scope 1 and Scope 2 baseline GHG emissions inventory

•committed to working towards reducing Scope 1 and Scope 2 GHG emissions by approximately half by 2030 and net zero by 2050, targets necessary to limit global temperature increases to 1.5 degrees Celsius

•completed a sustainable sourcing of land-based proteins position statement

•committed to sourcing at least 60% of land-based proteins from suppliers with deforestation-free supply chains by 2030

•committed to transitioning to 100% cage-free eggs in our global supply chain by 2030

Because we recognize the importance of good corporate citizenship and the value of sustainability and social responsibility to the Company and our stockholders, we take an active approach to sustainability and are committed to making socially responsible choices. To that end, our Company commitments with respect to Our People, Our Environment and Our Ingredients, including with respect to energy efficiency, water conservation and animal welfare, are available on our website. We encourage our stockholders to review these commitments.

As disclosed, the Company aspires to reduce its Scope 1 and Scope 2 GHG emissions by approximately half by 2030 and to net zero by 2050. During 2020, we reduced our total GHG emissions by 15%, our GHG emissions in natural gas by 17% and our GHG emissions in electric by 16%, in each case as compared to 2019. In addition to the installation of high-efficiency equipment and lighting across our restaurants to reduce energy usage, we also incorporate Leadership in Energy and Environmental Design™ (LEED) standards when constructing new restaurant buildings, while using the same standards when retrofitting existing restaurant buildings. As part of our water-saving initiative, we are committed to refitting our restaurants with water-efficient equipment and adopting water-efficient landscaping and inspection practices. The heated dipper well equipment we use, on its own, saves up to 250,000 gallons of water, per well, per year. As part of our ongoing efforts, we use recycled and reusable materials in our paper bags and entrée containers while encouraging a reduction in straw usage. As of February 2023, approximately 90% of our carryout packaging in the U.S. is recyclable or reusable and 100% of our paper carryout bags are made from recycled material. To eliminate food waste and transfer excess food to those who need it most, the Company has donated more than 14 million pounds of excess food through programs such as the Food Donation Connection network in the last nine years.

We continue to work with and encourage our suppliers to strengthen their practices to minimize their impact on activities that contribute to climate change. For example, we routinely engage in discussions with our primary beef suppliers in Brazil regarding their sustainability practices and commitments. Our largest beef supplier in Brazil has informed us that 100% of its direct suppliers are free of deforestation. This result is based on its third-party audit which reported, for the ninth consecutive year, that the processes for purchasing cattle from farms in the Amazon Biome complied with 100% of the criteria and guidelines established by the Public Commitment of Amazon Livestock. In addition, so that the consumer is aware of the origin of the raw material and/or ingredients, the traceability of the meat is informed on the labels of 100% of its products. In 2020, this primary beef supplier in Brazil launched an action plan to achieve 100% of its cattle supply chain being free of deforestation/conversion by 2025 in the Amazon biome, and by 2030 in the Cerrado. The supplier has indicated that its execution against this goal occurs according to the level of exposure of these regions to the risk of deforestation/conversion. We believe

continued active engagement with our primary suppliers is the most effective and efficient way to mitigate any adverse impacts of our operations in that region.

The Company has set GHG reduction goals and has several initiatives underway to meet these goals. The Board of Directors does not believe that preparation of the report requested by this proposal would result in better Company performance, assist with mitigation of climate change or increase returns to stockholders. In addition, the Company and the Board await the finalization of disclosure requirements related to climate change proposed by the SEC. Thus, the Board believes focusing on the SEC’s disclosure framework would be more beneficial to the stockholders while the Company also continues its action plan to meet GHG emission targets. We also continue to recover from the disproportionate impact that inflation, rising interest rates, supply chain disruptions, and the lingering effects of COVID-19 has had on the restaurant industry and in particular, the price and availability of commodities, and approval of this proposal would not result in an efficient use of resources. Implementation of such reporting would divert time, effort and resources from our current and planned initiatives and further expected reporting requirements, thereby limiting our ability to target our efforts on areas that will provide the most meaningful impact in mitigating climate change. For these reasons, we believe that the request by the proponent is unnecessary and has the potential to divert our resources with no corresponding benefit to the Company or its stockholders.

Recommendation of the Board of Directors

The Board of Directors unanimously recommends a vote AGAINST this proposal requesting that the Board issue a report outlining report outlining the Company’s near- and long-term science-based greenhouse gas (GHG) reduction targets aligned with the Paris Agreement, including the Company’s full range of operational and supply chain emissions.

The following table describes the beneficial ownership of Bloomin’ Brands, Inc. common stock as of February

28, 20187, 2023 (except as noted) by each person known to us to beneficially own more than 5% of our common stock, each director, and each named executive officer listed in the “Summary Compensation Table,” and all current directors and executive officers as a group. The number of shares of common stock outstanding used in calculating the percentage for each listed person includes the shares of common stock underlying options and restricted stock units beneficially owned by that person that are exercisable or will be settled within 60 days following February

28, 2018.7, 2023. The beneficial ownership percentages reflected in the table below are based on

92,932,75287,197,059 shares of our common stock outstanding as of February

28, 2018.7, 2023.

Except

as described below under “Certain Relationships and Related Party Transactions,” or as otherwise indicated in a footnote, all of the beneficial owners listed have, to our knowledge, sole voting, dispositive and investment power with respect to the shares of common stock listed as being owned by them. Unless otherwise indicated in a footnote, the address for each individual listed below is c/o Bloomin’ Brands, Inc., 2202 North West Shore Boulevard, Suite 500, Tampa, Florida 33607.

| | | | | | | | |

| NAME OF BENEFICIAL OWNER | | AMOUNT AND

NATURE OF

BENEFICIAL

OWNERSHIP | | | PERCENT OF

CLASS

(COMMON

STOCK) | |

Five Percent Shareholders: | | | | | | | | |

The Vanguard Group(1) 100 Vanguard Blvd. Malvern, PA 19355 | | | 11,174,868 | | | | 12.02 | % |

Jana Partners LLC(2) 919 Third Avenue New York, NY 10022 | | | 7,929,638 | | | | 8.53 | % |

BlackRock Inc.(3) 55 East 52nd Street New York, NY 10055 | | | 6,851,353 | | | | 7.37 | % |

AllianceBernstein L.P.(4) 1345 Avenue of the Americas New York, NY 01015 | | | 6,174,053 | | | | 6.64 | % |

RDB Equities(5) 4343 Anchor Plaza Pkwy Suite 1 Tampa, FL 33634 | | | 6,113,000 | | | | 6.58 | % |

Earnest Partners, LLC(6) 1180 Peachtree Street NE Suite 2300 Atlanta, GA 30309 | | | 5,268,819 | | | | 5.67 | % |

Directors and Named Executive Officers: | | | | | | | | |

Wendy Beck(7) | | | — | | | | * | |

Christopher W. Brandt(8) | | | 26,121 | | | | * | |

James R. Craigie(7) | | | 21,143 | | | | * | |

David J. Deno(9) | | | 640,166 | | | | * | |

David R. Fitzjohn(7) | | | 12,780 | | | | * | |

Mindy Grossman(7) | | | 29,790 | | | | * | |

Tara Walpert Levy(7) | | | 18,292 | | | | * | |

John J. Mahoney(7) | | | 26,372 | | | | * | |

R. Michael Mohan(7) | | | 976 | | | | * | |

Patrick Murtha(10) | | | 210,580 | | | | * | |

Sukhdev Singh(11) | | | 294,635 | | �� | | * | |

Elizabeth A. Smith(12) | | | 3,797,349 | | | | 3.93 | % |

Chris T. Sullivan(7)(13) | | | 1,209,187 | | | | 1.30 | % |

All current directors and executive officers as a group(12) | | | 7,352,795 | | | | 7.47 | % |

* | Indicates less than one percent of common stock. |

(1) | According to a Schedule 13G filed with the Securities and Exchange Commission (“SEC”) on February 7, 2018, reporting beneficial ownership of 11,174,868 shares, as of December 31, 2017, The Vanguard Group has sole voting power with respect to 180,951 shares,

|

14 Bloomin’ Brands,

| | | | | | | | | | | | | | |

| NAME OF BENEFICIAL OWNER | | AMOUNT AND NATURE OF BENEFICIAL OWNERSHIP | | PERCENT OF CLASS (COMMON STOCK) |

| Five Percent Stockholders: | | | | |

BlackRock Inc. (1)

55 East 52nd Street

New York, NY 10055 | | 13,908,086 | | | 15.95 | % |

The Vanguard Group (2)

100 Vanguard Blvd.

Malvern, PA 19355 | | 9,823,615 | | | 11.27 | % |

| | | | |

| Directors and Named Executive Officers: | | | | |

| James R. Craigie (3) | | 50,450 | | | * |

| David J. Deno (4) | | 1,205,402 | | | 1.37 | % |

| David R. Fitzjohn (3) | | 28,787 | | | * |

| John P. Gainor Jr. (3) | | 68,345 | | | * |

| Lawrence V. Jackson (3) | | 8,345 | | | * |

| Julie Kunkel (3) | | 1,000 | | | * |

| Kelly M. Lefferts (5) | | 93,616 | | | * |

| Tara Walpert Levy (3) | | 43,512 | | | * |

| John J. Mahoney (3) | | 51,470 | | | * |

| Melanie Marein-Efron (3) | | — | | | * |

| Christopher Meyer (6) | | 214,081 | | | * |

| R. Michael Mohan (3) | | 22,494 | | | * |

| Patrick Murtha (7) | | 6,465 | | | * |

| Gregg D. Scarlett (8) | | 697,612 | | | * |

| Elizabeth A. Smith (9) | | 1,264,405 | | | 1.43 | % |

| All current directors and executive officers as a group (10) | | 3,755,984 | | | 4.18 | % |

__________________

*Indicates less than one percent of common stock.

(1)According to a Schedule 13G/A filed with the SEC, on January 26, 2023, reporting beneficial ownership of 13,908,086 shares, as of December 31, 2022, BlackRock, Inc.— 2018 Proxy Statement has sole voting power with respect to 13,766,078 shares and sole dispositive power with respect to 13,908,086 shares.

| shared voting power with respect to 12,900 shares, sole dispositive power with respect to 10,988,817 shares, and shared dispositive power with respect to 186,051 shares. |

(2) | According to a Schedule 13G filed with the SEC on February 28, 2018, reporting beneficial ownership of 7,929,638(2)According to a Schedule 13G/A filed with the SEC on February 9, 2023, reporting beneficial ownership of 9,823,615 shares, as of December 31, 2017, Jana Partners, LLC has sole voting power with respect to 7,929,638 shares and sole dispositive power with respect to 7,929,638 shares. |

(3) | According to a Schedule 13G filed with the SEC on January 29, 2018, reporting beneficial ownership of 6,851,353 shares, as of December 31, 2017, BlackRock, Inc. has sole voting power with respect to 6,645,175 shares and sole dispositive power with respect to 6,851,353 shares. |

(4) | According to a Schedule 13G filed with the SEC on February 14, 2018, reporting beneficial ownership of 6,174,053 shares, as of December 31, 2017, Alliance Bernstein, LP has sole voting power with respect to 5,279,220 shares and sole dispositive power with respect to 6,174,053 shares. |

(5) | According to a Schedule 13G filed with the SEC on March 31, 2017, reporting beneficial ownership of 6,113,000 shares, as of December 31, 2017, RDB Equities has sole voting power with respect to 6,113,000 shares and sole dispositive power with respect to 6,113,000 shares. |

(6) | According to a Schedule 13G filed with the SEC on February 14, 2018, reporting beneficial ownership of 5,268,819 shares, as of December 31, 2017, Earnest Partners, LLC has sole voting power with respect to 1,377,532 shares, shared voting power with respect to 371,936 shares and sole dispositive power with respect to 5,268,819 shares. |

(7) | Includes the following number of restricted stock units that will vest within 60 days of February 28, 2018: Ms. Beck, 0 shares; Mr. Craigie, 5,235 shares; Mr. Fitzjohn, 5,235 shares, Ms. Grossman, 5,235 shares; Ms. Levy, 5,235 shares; Mr. Mahoney, 5,235 shares; Mr. Mohan, 976 shares; and Mr. Sullivan, 0 shares. Does not include the following number of restricted stock units that will not vest within 60 days of February 28, 2018: Ms. Beck, 0; Mr. Craigie, 5,532 shares; Mr. Fitzjohn, 5,532 shares; Ms. Grossman, 5,532 shares; Ms. Levy, 5,532 shares; Mr. Mahoney, 5,532 shares; Mr. Mohan, 1,952 shares; and Mr. Sullivan 0 shares. Mr. Craigie’s shares include 4,040 shares held in trust for the benefit of his children and Mr. Craigie disclaims beneficial ownership of these shares except to the extent of his pecuniary interest therein. |

(8) | Includes 12,500 shares subject to stock options with an exercise price of $19.25. |

(9) | Includes 14,480 shares subject to stock options with an exercise price of $17.27 per share, 28,288 shares subject to stock options with an exercise price of $17.15 per share, 41,820 shares subject to stock options with an exercise price of $25.36 per share, 58,800 shares subject to stock options with an exercise price of $25.32 per share, 72,551 shares with an exercise price of $17.40, 400,000 shares with an exercise price of $14.58 per share that Mr. Deno has the right to acquire within 60 days of February 28, 2018. Does not include 128,587 shares subject to stock options, 48,698 restricted stock units and 55,172 performance share units that are not exercisable or will not vest within 60 days of February 28, 2018. |

(10) | Includes 8,704 shares subject to stock options with an exercise price of $17.15 per share, 11,029 shares subject to stock options with an exercise price of $25.36 per share, 175,000 shares subject to stock options with an exercise price of $25.36 per share that Mr. Murtha has the right to acquire or that will vest within 60 days of February 28, 2018. |

(11) | Includes 21,163 shares subject to stock options with an exercise price of $17.27 per share, 16,538 shares subject to stock options with an exercise price of $17.15 per share, 12,408 shares subject to stock options with an exercise price of $25.36 per share, 200,000 shares subject to stock options with an exercise price of $22.09 per share that Mr. Singh has the right to acquire or that will vest within 60 days of February 28, 2018. Does not include 104,799 shares subject to stock options, 65,058 restricted stock units, and 44,871 performance share units that are not exercisable or will not vest within 60 days of February 28, 2018. |

(12) | Includes 66,831 shares subject to stock options with an exercise price of $17.27, 130,561 shares subject to stock options with an exercise price of $17.15 per share, 165,441 shares subject to stock options with an exercise price of $25.36 per share, 177,940 shares subject to stock options with an exercise price of $25.32 per share, 550,000 shares with an exercise price of $10.03 per share, 2,562,424 shares subject to stock options with an exercise price of $6.50 per share that Ms. Smith has the right to acquire within 60 days of February 28, 2018. Does not include 571,900 shares subject to stock options, 219,466 restricted stock units and 246,894 performance share units that are not exercisable or will not vest within 60 days of February 28, 2018. |

(13) | Includes 807,899 shares owned by CTS Equities, Limited Partnership, an investment partnership (“CTSLP”). Mr. Sullivan is a limited partner of CTSLP and the sole member of CTS Equities, LLC, the sole general partner of CTSLP. Also includes 399,296 shares held by a charitable foundation for which Mr. Sullivan serves as trustee. The shares held by CTSLP are pledged to Fifth Third Bank to secure debt of approximately $18 million. |

(14) | Includes a total of 5,438,853 shares subject to stock options, 33,401 restricted stock units and 0 performance share units that our current directors and executive officers have the right to acquire or that will vest within 60 days of February 28, 2018. Does not include a total of 1,392,189 shares subject to stock options, 558,199 subject to restricted stock units and 481,435 shares subject to performance share units that our current directors and executive officers do not have the right to acquire within 60 days of February 28, 2018. |

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of December 30, 2022, The Vanguard Group has shared voting power with respect to 123,330 shares, sole dispositive power with respect to 9,623,703 shares and shared dispositive power with respect to 199,912 shares.

(3)Does not include the Exchange Act requiresfollowing number of RSUs that will not vest within 60 days of February 7, 2023: Mr. Craigie, 20,147 shares; Mr. Fitzjohn, 13,975 shares; Mr. Gainor, 13,761 shares; Mr. Jackson, 13,761 shares; Ms. Kunkel 4,142 shares; Ms. Levy, 13,975 shares; Mr. Mahoney, 13,975 shares; Ms. Marein-Efron 4,142 shares; and Mr. Mohan, 13,975 shares. Mr. Craigie’s shares include 4,040 shares held in trust for the benefit of his children, and Mr. Craigie disclaims beneficial ownership of these shares except to the extent of his pecuniaryinterest therein. Mr. Gainor’s shares include 51,500 shares, held in a revocable trust, for which he holds joint beneficial ownership with his spouse, and 8,500 shares held in his IRA. Ms. Kunkel’s shares include 1,000 shares held in her IRA.

(4)Includes 270,758 shares subject to stock options with an exercise price of $20.62 per share, 50,345 shares subject to stock options with an exercise price of $21.29 per share, 42,917 shares subject to stock options with an exercise price of $24.10 per share, 57,921

shares subject to stock options with an exercise price of $17.27 per share, 56,577 shares subject to stock options with an exercise price of $17.15 per share, 55,760 shares subject to stock options with an exercise price of $25.36 per share, 58,800 shares subject to stock options with an exercise price of $25.32 per share and 56,143 RSUs and 171,762 PSUs that Mr. Deno has the right to acquire within 60 days of February 7, 2023. Does not include 58,215 RSUs and 225,476 PSUs that are not exercisable or will not vest within 60 days of February 7, 2023.

(5)Includes 7,281 shares subject to stock options with an exercise price of $21.29 per share, 5,703 shares subject to stock options with an exercise price of $24.10 per share, 4,200 shares subject to stock options with an exercise price of $25.36 per share, 3,407 shares subject to stock options with an exercise price of $25.32 per share and 8,009 RSUs and 28,390 PSUs that Ms. Lefferts has the right to acquire within 60 days of February 7, 2023. Does not include 7,275 RSUs and 25,106 PSUs that are not exercisable or will not vest within 60 days of February 7, 2023.

(6)Includes 69,043 shares subject to stock options with an exercise price of $20.62 per share, 9,682 shares subject to stock options with an exercise price of $21.29 per share, 7,222 shares subject to stock options with an exercise price of $24.10 per share, 6,591 shares subject to stock options with an exercise price of $17.27 per share, 4,207 shares subject to stock options with an exercise price of $17.15 per share, 6,251 shares subject to stock options with an exercise price of $25.36 per share, 3,194 shares subject to stock options with an exercise price of $25.32 per share and 9,513 RSUs and 28,390 PSUs that Mr. Meyer has the right to acquire within 60 days of February 7, 2023. Does not include 9,547 RSUs and 32,951 PSUs that are not exercisable or will not vest within 60 days of February 7, 2023.

(7)Includes 4,812 RSUs that Mr. Murtha has the right to acquire within 60 days of February 7, 2023. Does not include 7,275 RSUs and 25,106 PSUs that are not exercisable or will not vest within 60 days of February 7, 2023.

(8)Includes 100,000 shares subject to stock options with an exercise price of $18.45 per share, 46,472shares subject to stock options with an exercise price of $21.29 per share, 36,974 shares subject to stock options with an exercise price of $24.10 per share, 36,090 shares subject to stock options with an exercise price of $17.27 per share, 100,000 shares subject to stock options with an exercise price of $17.96 per share, 16,973 shares subject to stock options with an exercise price of $17.15 per share, 100,000 shares subject to stock options with an exercise price of $24.14 per share, 14,706 shares subject to stock options with an exercise price of $25.36 per share, 12,166 shares subject to stock options with an exercise price of $25.32 per share and 30,173 RSUs and 85,200 PSUs that Mr. Scarlett has the right to acquire within 60 days of February 7, 2023. Does not include 14,730 RSUs and 50,838 PSUs that are not exercisable or will not vest within 60 days of February 7, 2023.

(9)Includes 372,292 shares subject to stock options with an exercise price of $20.62 per share, 185,695 shares subject to stock options with an exercise price of $24.10 per share, 64,295 shares subject to stock options with an exercise price of $17.27 per share, 220,589 shares subject to stock options with an exercise price of $25.36 per share and 177,940 shares subject to stock options with an exercise price of $25.32 per share that Ms. Smith has the right to acquire within 60 days of February 7, 2023. Does not include 13,975 RSUs that will not vest within 60 days of February 7, 2023.

(10)Includes a total of 2,204,051 shares subject to stock options and 108,650 RSUs and 313,742 PSUs that our current directors and executive officers have the right to acquire or that will vest within 60 days of February 7, 2023. Does not include a total of 222,870 shares subject to RSUs and persons who own more than 10%359,477 shares subject to PSUs that our current directors and executive officers do not have the right to acquire within 60 days of our common stock file reportsFebruary 7, 2023.

EXECUTIVE COMPENSATION AND RELATED INFORMATION

Compensation Discussion and Analysis

Introduction

and Executive Summary

This Compensation Discussion and& Analysis details the objectives and design(“CD&A”) provides a comprehensive description of our executive pay program,design objectives and an overview of how program features are carefully designed to ensure compensation program.outcomes directly align to the company performance objectives. It includes a description of the compensation provided in 20172022 to our named executive officers (“NEOs”) who are listed below and named in the Summary Compensation Table (“NEOs”).Table.

| | | | | |

Elizabeth A. Smith

David J. Deno | | Chairman of the Board of Directors and Chief Executive Officer |

David J. Deno

Christopher A. Meyer | | Executive Vice President, Chief Financial and Administrative Officer |

Christopher W. Brandt(1)

Kelly M. Lefferts | | Executive Vice President, Chief BrandLegal Officer and Secretary |

Patrick C. Murtha(1) | | Executive Vice President, President, Bloomin’ BrandsFleming’s and International |

Sukhdev Singh

Gregg D. Scarlett | | Executive Vice President, Global Chief DevelopmentOperating Officer, and FranchisingCasual Dining Restaurants |

(1) | Messrs. Brandt and Murtha departed from the Company as of December 31, 2017. |

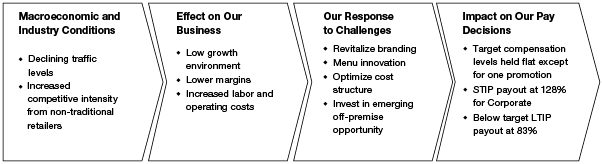

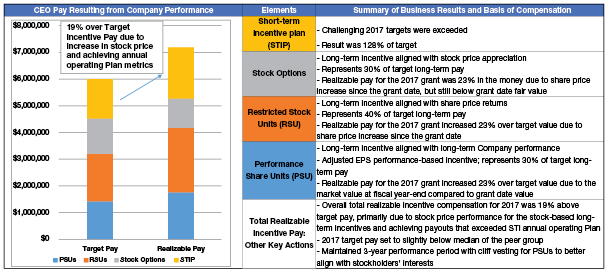

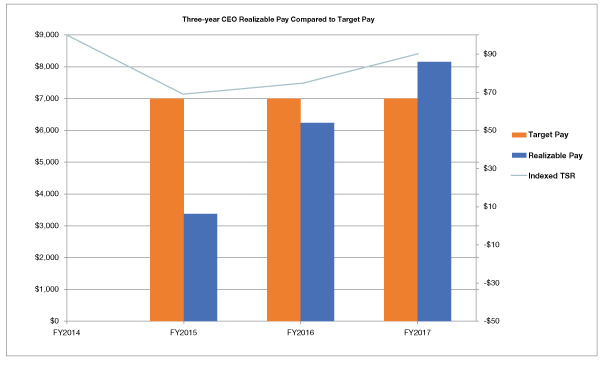

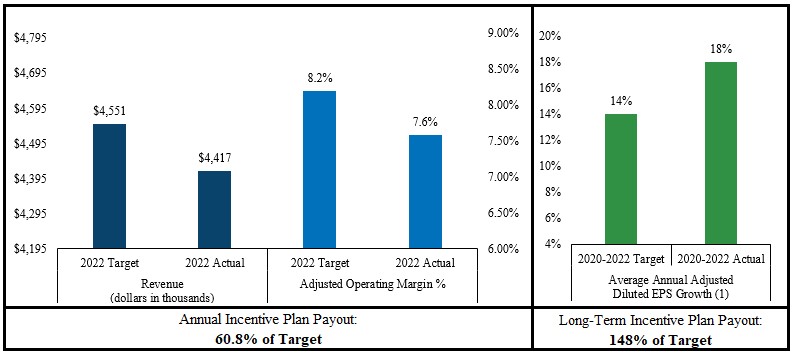

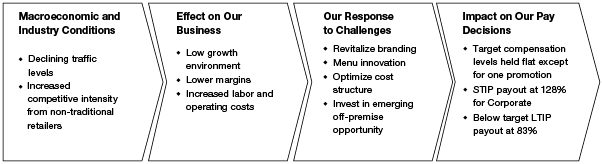

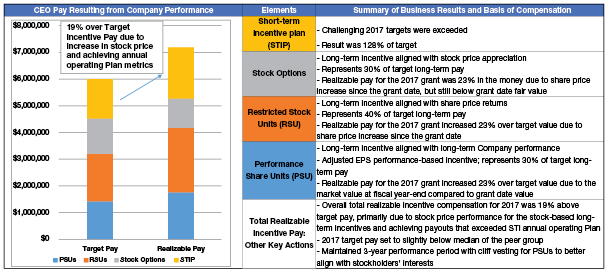

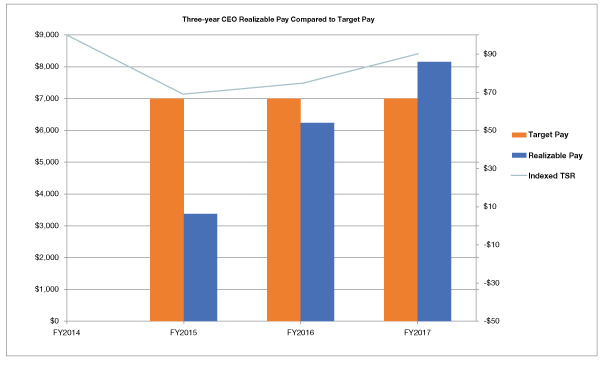

Strong Execution on Long-Term Plan Despite Market ContextHeadwinds:

Bloomin’ Brands continued to execute its long-term strategy and

Our Response2017 Macroeconomic and Industry Conditions and the Effect on Our Business